2025 Ira Withdrawal Rules. Christine benz mar 20, 2025. The secure 2.0 act, though, raised the age for rmds to 73 for those.

Play by the rules with your retirement accounts and you can accumulate a lot of money over time. Limit increases to $23,000 for 2025, ira limit rises to $7,000. internal revenue service.

Rule 72 (t) allows early withdrawals without penalties if you take at least five equal periodic payments from your account over at least five years.

The irs has again waived required withdrawals for certain americans who have inherited retirement accounts since 2025.

Traditional Ira Tax Deduction Limits 2025 Eryn Odilia, Secure 2.0 expanded the avenues for. Rule 72 (t) allows early withdrawals without penalties if you take at least five equal periodic payments from your account over at least five years.

The 5Year Rules for Roth IRA Withdrawals Pure Financial Advisors, Generally, unless you meet the criteria for an exception, the irs penalizes withdrawals before age 59 1/2 with a 10% fee. Ira rules in 2025 and 2025.

Roth IRA Withdrawal Rules and Penalties The TurboTax Blog, The irs has again waived required withdrawals for certain americans who have inherited retirement accounts since 2025. So as you retire, rebalance your ira around these needs.

The 5Year Rules for Roth IRA Withdrawals Pure Financial Advisors, Play by the rules with your retirement accounts and you can accumulate a lot of money over time. The irs has again waived required withdrawals for certain americans who have inherited retirement accounts since 2025.

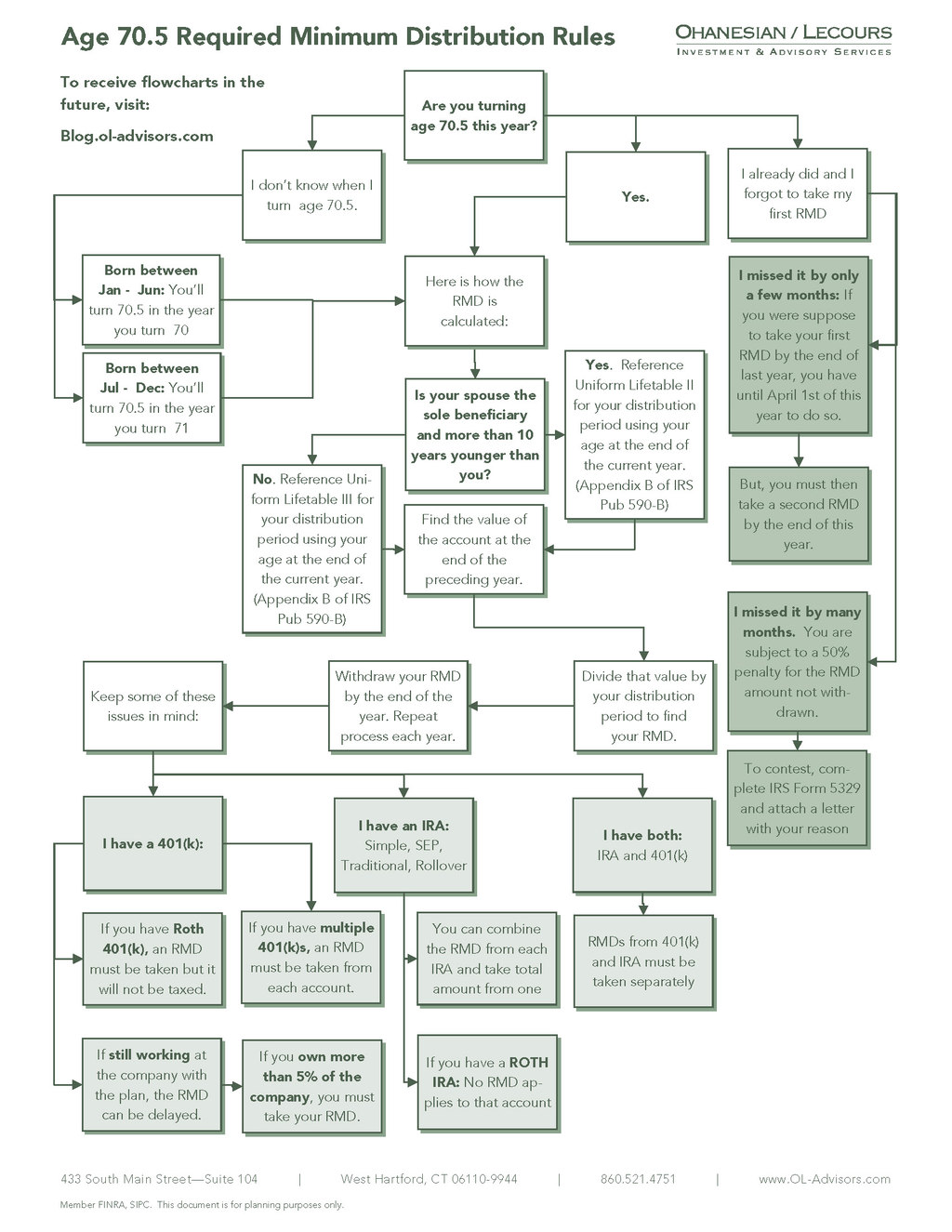

Visualizing IRA Rules Using Flowcharts, Like before you turn 59½, you can withdraw roth ira contributions. Please speak with your tax advisor.

Roth IRA Withdrawal Rules and Penalties The TurboTax Blog, Retirement account owners must take required minimum distributions from traditional iras and 401 (k)s after a certain age. You must begin receiving required minimum distributions by april 1 of the year following the year you reach.

Simple Ira Contribution Limits 2025 Over Age 50 Katya Melamie, Avoid the early withdrawal penalty by knowing these rules. While you can only make contributions to a roth ira as long as your income is under a certain amount ($161,000 for single filers in 2025, and $240,000 if you’re.

New RMD Tables 2025 IRA Required Minimum Distribution That Retirees, Be aware of these new rules for inherited iras. Like before you turn 59½, you can withdraw roth ira contributions.

What Are The New Ira Distribution Rules Tutor Suhu, The age for withdrawing from retirement accounts was increased in 2025 to 72 from 70.5. Beginning in 2025, designated roth accounts will not be subject to the rmd rules while the account owner is still alive.

IRA Contribution Limits in 2025 Meld Financial, Please speak with your tax advisor. So, there are no tax benefits today.

Ira withdrawals are considered early before you reach age 59½, unless you qualify for another exception to the tax.